The Silo Tax: Why We Built the Financial Integrity Layer

In the last decade, we have seen a massive shift in enterprise software. Companies have moved their ledgers to the cloud (Dynamics 365, Xero) and their banking to sophisticated host-to-host networks.

But there is a dangerous gap in the middle. We call it The Silo Tax.

It is the hidden risk of having "Best of Breed" systems that refuse to talk to each other. It looks like a Finance Manager downloading an ABA file to their desktop, editing a line item in Notepad to fix a date, and manually uploading it to the bank.

In security terms, this is a "Man-in-the-Middle" vulnerability that you created yourself. It is the single biggest fraud vector in modern finance teams.

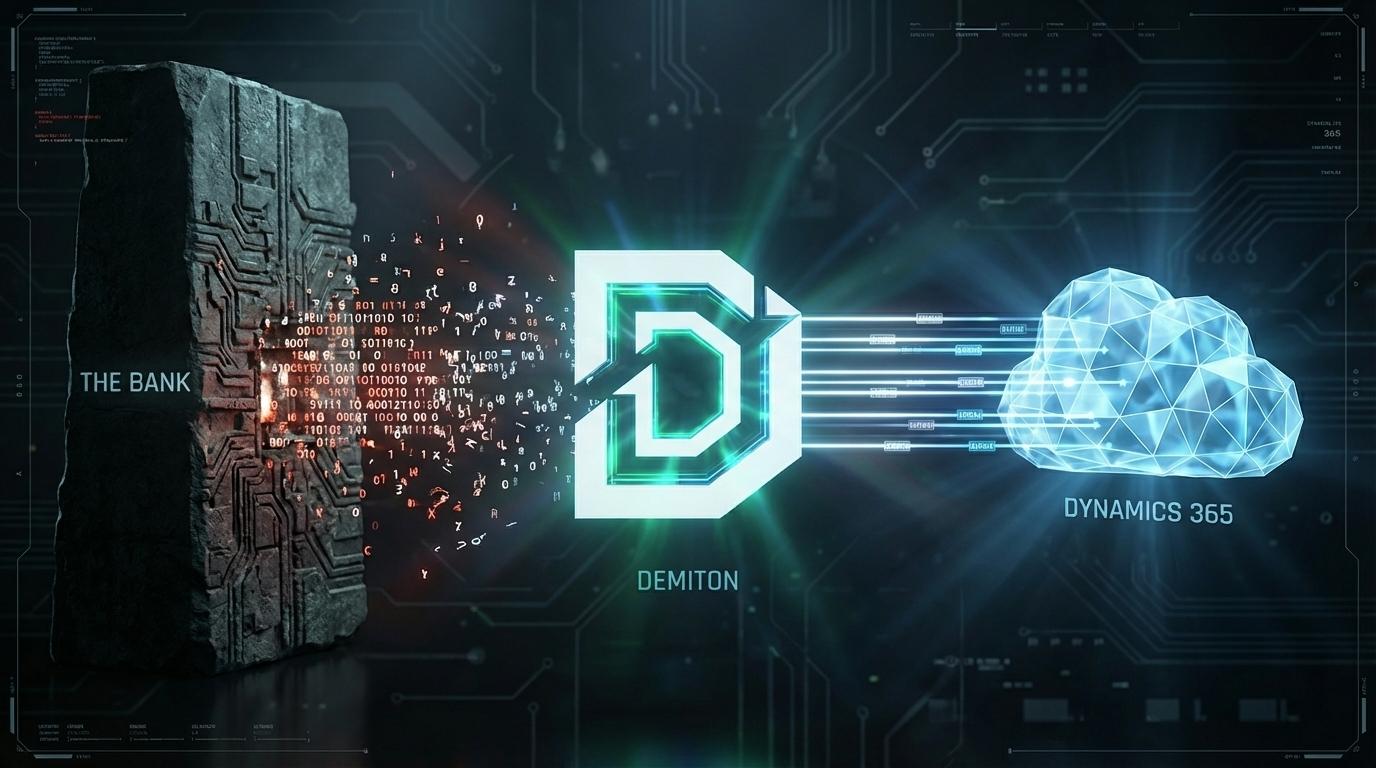

Today, we are announcing the solution: The Demiton Financial Integrity Layer.

The Problem: The "Last Mile" Vulnerability

When you strip away the buzzwords, most finance teams are still acting as manual data couriers.

- The Outbound Risk: When a payment file leaves the ERP, it becomes a static text file on a laptop. That file is unencrypted, editable, and detached from identity governance. If a BSB is swapped here, the ERP logs show nothing.

- The Inbound Blindness: You don't know your cash position until 9:00 AM the next day, after someone has manually downloaded the BAI2 statement and wrestled it into a reconciliation journal.

We realized that building another "connector" wasn't enough. You don't need a pipe; you need Sovereign Infrastructure.

Introducing the Integrity Layer

Demiton is no longer just an automation tool. We have evolved into a Sovereign Financial Operating System.

Our Banking Gateway is a managed enclave that secures the "Last Mile" between Dynamics 365 and the Australian Banking Grid.

1. The RAM-Disk Enclave (Ghost Protocol)

We believe that humans should approve payments, not handle files.

With Demiton, the moment a Payment Journal is posted in Dynamics 365, our gateway picks it up. We generate the ABA file in volatile memory (RAM), encrypt it immediately via PGP, and transmit it directly to the bank via a secure SFTP tunnel.

- No downloads.

- No desktop storage.

- No opportunity for tampering.

2. Protocol Zero Governance

Identity is not a password; it is a cryptographic signature.

We enforce Protocol Zero: a governance model where the user's Microsoft Entra ID (Azure AD) signature is bound directly to the SHA-256 hash of the transaction payload. If the file is altered by a single byte during transit, the signature breaks and the bank rejects the file.

3. Sovereign Security

We know that trust is the currency of finance. That is why we didn't just build a script; we built a fortress.

- Key Vaulting: We manage the RSA-4096 keys. Your developers never see them.

- Static IP Egress: We route all traffic through a dedicated, allow-listed IP address that your bank trusts.

- Australian Sovereignty: All production data resides in

australia-southeast1(Sydney). It never leaves the jurisdiction.

The Pioneer Alliance

Enterprise software shouldn't be a black box. You shouldn't have to sign a contract to validate the architecture.

That is why we are opening the Partner Alliance—a program for Solution Architects and Dynamics Partners to access NFR (Not For Resale) licenses. Build, test, and demo the secure tunnel in your own sandbox before deploying to clients.

The era of "Manual Glue" is over. It’s time to secure the network.

Stop fixing broken CSV integrations.

Join the Partner Alliance. Get an NFR license to build a bank-grade "Iron Layer" for your practice and eliminate the liability of manual file uploads.